From grants to venture capital, crowdfunding to loans, start-ups in Ireland have numerous avenues to secure funding. This article provides a comprehensive overview of the start-up funding landscape in Ireland, guiding entrepreneurs through the various stages of funding and the available sources of capital.

Understanding the basics of Start-Up Funding

Start-up funding refers to the money raised by a new company to finance its initial operations, growth, and development. This funding can come from various sources, each offering different amounts of capital, terms, and conditions. The process usually begins with seed funding, followed by Series A, B, and C funding rounds.

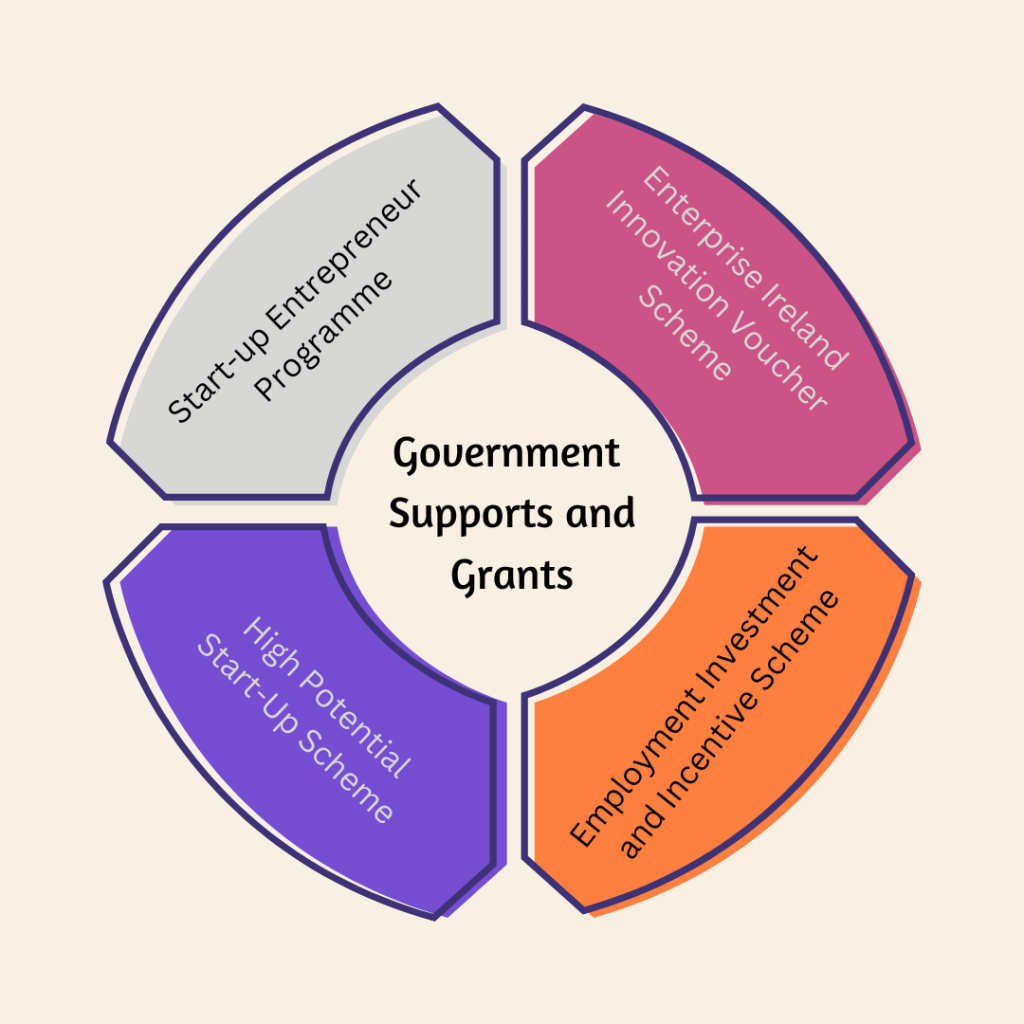

Government Supports and Grants

The Irish government offers numerous schemes to support start-ups, one of which is the Enterprise Ireland Innovation Voucher Scheme. The government also provides the Employment Investment and Incentive Scheme (EII) that offers tax relief for Irish taxpayers who invest in certain companies. The High Potential Start-Up (HPSU) Scheme is another initiative for start-ups with the potential to develop an innovative product or service for sale on international markets. Lastly, the Start-up Entrepreneur Programme (STEP) is a government initiative allowing innovative entrepreneurs to establish their businesses and reside in Ireland.

Venture Capital Funding

Venture Capital firms usually invest in companies in their early stages of development that have high growth potential. Some renowned venture capital firms in Ireland include Kernel Capital and Atlantic Bridge Ventures. Venture capital firms usually participate in Series A, B, and C funding rounds.

Furthr has its own venture capital firm, Furthr VC, which invests in early-stage startups in the B2B SaaS and MedTech sectors. Furthr VC is one of the most active early-stage VCs in Ireland and is hands-on, providing support to teams across key strategic areas to accelerate growth.

Crowdfunding

Crowdfunding is a method of raising capital through the collective efforts of people via platforms like Spark Crowdfunding. Crowdfunding in Ireland can be categorised into donation-based, reward-based, equity-based, and debt-based crowdfunding.

Personal Savings and Loans

Personal savings and loans from financial institutions are other options for financing a start-up. Loans must be repaid with interest, so this decision should be made cautiously.

R&D Tax Credits

Ireland offers generous R&D tax credits to start-ups. Even if a start-up is in the loss-making phase, these tax breaks may provide immediate cash flow benefits. The programme allows businesses to claim a tax credit of 25% on eligible R&D expenditure. It encourages innovation, attracts investment, and supports the growth of the Irish economy. Companies can also exploit intellectual property at favourable tax rates and avail of accelerated tax depreciation allowances for energy-efficient equipment. The R&D tax credit regime in Ireland changed in 2022 to a fully payable credit paid in three fixed instalments over three years, with no cap on the amount of credit that can be monetised.

Tax Incentives

Ireland’s favourable tax regime makes companies based in Ireland more attractive to investors. This includes a low corporation tax rate of 12.5% combined with favourable double tax agreements.

Business Angels and Seed Funds

A strong and growing network of local Business Angels, Seed Funds, and Venture Capitalists (VCs) exists in Ireland. They often have experience in the sector and industry contacts that can help get the business in motion. Angel investors can be a good option for funding start-ups as banks are usually reluctant to lend money to new entrepreneurs. These investors assess the potential profitability and risks of a business before investing.

Start-Up Accelerator Programmes

Ireland has a network of start-up accelerator programmes. Almost all of these provide some form of funding to participants in addition to mentoring, incubation space, and workshops.

Furthr delivers a range of accelerator programmes designed by our experienced team of mentors. These accelerators are informed by our deep experience of advising businesses on how to grow and scale, and connecting them with investors since 1998.

Our accelerator programmes include:

Ready, Set, Go Furthr – A one-day pre-accelerator workshop to help ambitious founders get started on the right path, uncovering the fundamentals of the entrepreneurial journey.

Furthr Foundry – A 12-week accelerator programme for ambitious Startups who are looking to raise pre-seed funding nationally or internationally.

Venture Build – Delivered by Furthr on behalf of Enterprise Ireland, the Venture Build programme, delivered over a six-month period has been designed specifically for Enterprise Ireland HPSU clients who are engaged in DeepTech and Life Sciences research.

Prep4Seed – Prep4Seed is delivered by Furthr and the Irish BICS on behalf of Enterprise Ireland. A 3-month programme designed to support Enterprise Ireland HPSU clients in identifying and delivering critical milestones required to progress their business and raise investment in their seed round.

Enterprise Ireland

Enterprise Ireland provides a myriad of support for the startup community, focusing on high-potential, export-oriented businesses. These supports include financial aid, professional advice, mentoring, and assistance with international expansion. Supports are provided through experienced advisors and are either free or heavily subsidised, catering to the specific needs of Irish startups. In addition to public funding, they help startups access private funding sources, making Ireland a conducive environment for startup growth. Furthr’s business consultants prep and guide founders to better equip them to apply and successfully attain these funding supports.

Local Enterprise Offices

Local Enterprise Offices offer advice, information, and support to start-ups and growing businesses. Supports include start-your-own-business training courses, market research information, business planning advice, and templates, access to experienced business mentors, feasibility grants, and co-investment.

Funding is a critical factor for the success of any start-up. Entrepreneurs need to understand the various sources of funding available and make informed decisions. Whether it’s government grants, venture capital, crowdfunding, personal savings, loans, or other sources, each offers unique advantages and considerations. Ultimately, the best funding option depends on the specific needs, goals, and circumstances of the start-up.

Want to know more about the support you have? Talk to us at hello@furthr.ie .