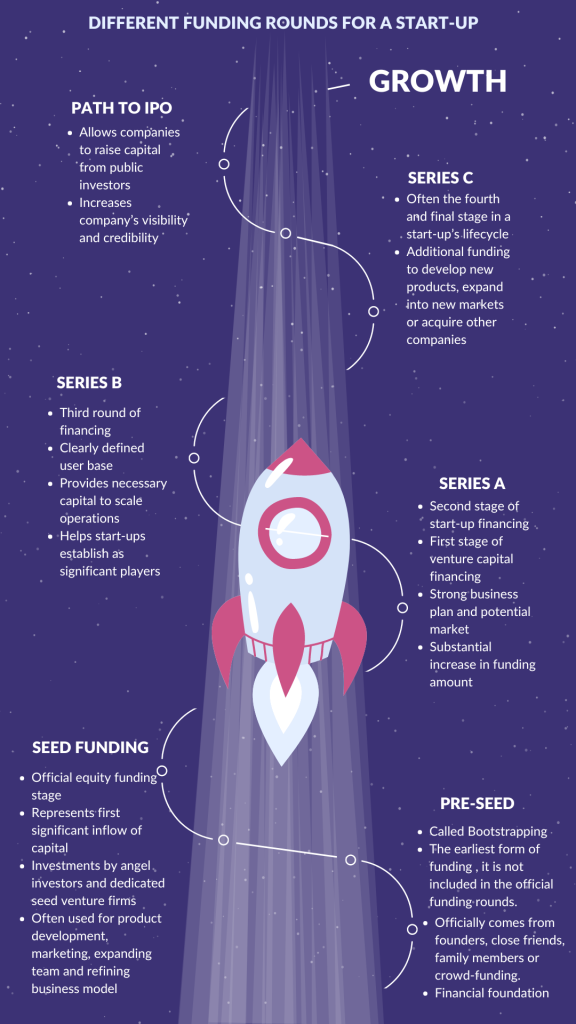

Starting a new business venture is an exciting journey filled with endless possibilities. However, turning these possibilities into reality often requires substantial financial resources. For this reason, many entrepreneurs pursue different types of funding rounds to amass the crucial capital needed to propel their startups towards success. This article will walk you through the entire funding process, from pre-seed funding to Series C funding, and even beyond.

Pre-Seed Funding: Planting the Initial Seed

Pre-seed funding is the first, step in the capital-raising process. At this stage, the startup is merely an idea, and the founders are responsible for its initial growth. Most pre-seed funding is sourced from the founders themselves, alongside contributions from the founders, close friends, family members, or even through crowdfunding initiatives.

While Pre-Seed is not typically included in the official funding rounds, it plays a pivotal role in getting the startup off the ground, covering initial operational costs such as market research, product development, and business model formulation.

Seed Funding: Nurturing the Seed

The next stage is seed funding once the startup has a solid foundation. Seed funding is the initial official equity funding stage. It represents the first significant inflow of capital that a business venture receives, often from angel investors or dedicated seed venture capital firms.

Seed funding is often used for product development, marketing initiatives, hiring key team members, and refining the business model. This early infusion of capital waters the “seed” planted during the pre-seed stage, helping the startup to grow.

Seed funding can be key to a business’s go-to-market strategy. A successful seed funding round not only provides the necessary capital but also validates the startup’s business idea, instilling confidence in both the founders and the investors.

Series A Funding: Constructing a Solid Business Model

After the seed funding stage, startups usually progress to Series A funding. At this point, startups are expected to have a cogent plan for developing a sustainable business model. This stage is crucial, as it typically involves a substantial increase in the funding amount.

Series A funding is provided by venture capital financing and angel investors. At this stage, startups are expected to present a strong business plan and demonstrate a potential market for their product or service. The funds raised during this round are often used for product development, marketing, and team expansion.

Series A funding is a significant milestone in a startup’s growth journey. It signifies that the startup has shown promising traction in its market and is ready to take the next step in its growth plan. The financial boost from Series A funding helps startups optimise their product and market fit, setting the stage for future funding rounds.

Series B Funding: Scaling Up Operations

Once a startup has a solid business model and a growing user base, it is time to move on to Series B funding. This stage is all about taking the business to the next level, beyond the development stage, by expanding the market reach.

Series B funding is usually the third round of financing for a startup. By this stage, the company has already proven its concept – its product or service has been well received by consumers, and there’s a clearly defined user base. The capital raised during this round often goes into bolstering the business structure, including team expansion, sales and marketing efforts, and even acquisitions if necessary.

With the financial backing from Series B funding, startups can truly begin to establish themselves as significant players in their respective markets.

Series C Funding: Expanding Further and Beyond

Startups that make it to Series C funding are usually quite successful and have a proven track record of using funds to grow their operations. This stage focuses on scaling the company and growing as quickly and successfully as possible.

Series C funding is often the final stage in a startup’s funding lifecycle. At this stage, startups typically seek additional funding to help them develop new products, expand into new markets, or even acquire other companies. The investors at this stage are usually venture capitalists who focus on late-stage investing.

Series C funding plays a crucial role in the expansion and scaling of successful businesses. It provides the necessary capital to pursue new market opportunities and consolidate the startup’s position in the market. At this stage, startups may also use the funding to acquire other companies and diversify their product or service offerings.

Beyond Series C: The Path to an IPO

After Series C, some companies may opt for additional funding rounds such as Series D, E, and beyond if they have substantial growth plans that require more capital. These rounds are less common and usually involve significant amounts of capital from large institutional investors. The ultimate goal for many startups is to reach an Initial Public Offering (IPO), where the company’s shares are sold to the general public, marking a significant milestone in the company’s growth journey.

What is an IPO?

An IPO, or Initial Public Offering, is a process in which a private company offers its shares to the public in a new stock issuance. This allows the company to raise capital from public investors. The transition from a private company to a public company is a significant event that offers many advantages, as well as new challenges.

The Significance of an IPO

Reaching an IPO is a notable achievement for any startup. It signifies that the company has grown from a small startup to a large public company. Not only does an IPO provide a company with access to capital from public investors, but it also increases the company’s visibility and credibility in the market.

Final thoughts on Start-Up Funding Rounds

Startup funding rounds are a critical part of a company’s journey from a small startup to a large public company. Each round serves a specific purpose, whether it’s getting the startup off the ground, developing a business model, scaling operations, or preparing for an IPO. As a founder, understanding the different stages of funding can help you plan your fundraising strategy effectively and ensure that your company has the capital it needs to grow and succeed.

For startups based in Ireland, there are several unique opportunities available for raising funds. This includes applying for government grants through schemes such as the Enterprise Ireland Innovation Voucher Scheme. There are also a number of venture capital firms, such as our own Furthr VC, based in Ireland that offer funding opportunities for startups. Additionally, crowdfunding has become an increasingly popular method for startups to raise funds in Ireland, with platforms like Spark Crowdfunding, Fund it, SeedUps Ireland, and Linked Finance helping a diverse range of projects secure the necessary funds.

For more information about startup funding rounds or any other enquiries, please feel free to get in touch with us at hello@furthr.ie. We’re always here to help guide you through the complex world of startup funding.